Enter words related to your business to get started.

How to Change Your Business Name:

Sometimes a new business name is what you need to take your company in a different direction. It's possible to change the name of a business that you've already set up. We've put together this guide to show you how to change the name of your business.

Secure a new name.

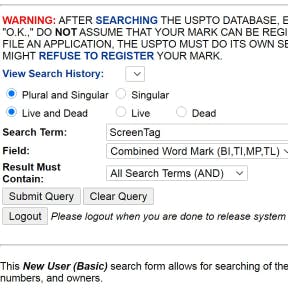

Do a state and trademark name search.

Before you change the name of your business, make sure that the new name you want to use is still available. Search your state's business directory to see if there are any other businesses using your name. You can use USPTO.gov to do a national trademark search. If neither of these searches provides any results, then the name that you want to use is still available.

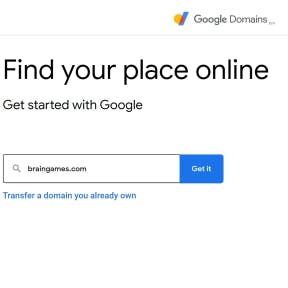

Check for domain availability.

Use an online tool like Namecheap to search for a domain name that matches your new business name. If it is still available with the extension that you want (.com, .org, .io) then purchase it right away.

If the domain name that you want isn't available, it isn't too late to go back to the drawing board. A good domain name is important for online SEO, so consider looking for other names if your first option is available.

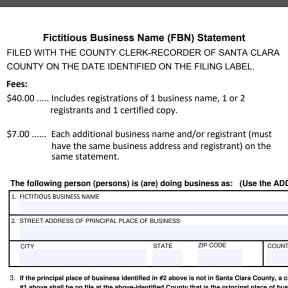

File for an amendment or DBA.

If you want to change the name that you business is registered under with your state, you will most likely have to file an amendment. If, however, you want to keep the original name but start doing business as another name, you can file for a DBA (doing business as). Most states charge a small fee for these changes.

Contact your state's small business office or Secretary of State department to find out what the fees and requirements are for a name change.

Notify the IRS of the change.

Use the form that corresponds to your business entity.

The process is slightly different for each type of business entity (corporation, partnership, or sole proprietorship). Find out which form you need to complete by visiting the IRS website.

Get a new EIN.

Use the IRS online application.

If your business needs a new Employer Identification Number as the result of a name change, you can complete the EIN application online.

The new EIN that you are assigned will be distinctly tied to your new business name.

A new EIN is not always necessary when changing your business name. See IRS Publication 1635 to find out of your business requires a new EIN.

Change your branding.

Update your website.

WIth a new business name, it's absolutely essential that you change the name our your website. Take your new domain name and attach it to your website so that your online branding is consistent.

If you're already in the process of changing your business name, it might be the perfect time to overhaul your website.

Notify your clients/customers.

Your customers will be confused if you suddenly change your business name without an explanation. To provide your current customers with continuity, send out an email explaining the motivation for the name change. Send out the same message on social media so that everyone is aware of what is going on.

A name change can be unsettling for long-time customers. Reassure everyone that the quality of your products and/or services has not changed.