Enter your brand or company name to get started.

How to Start an Online Business — Checklist Download

Download our free "How to Start an Online Business" Checklist in PDF format.

Download Now

Online Business Plan — Free Template

Download our free Online Business Plan in MS Word format.

Download NowHow to Start an Online Business:

A step-by-step guide on how to start an online business.

Decide what kind of online business you would like to start.

Choose what to sell.

Most online businesses either sell products or services. Finding an underserved need in the market is a good way to ensure that your business will have a consumer base.

Find a niche.

Ask yourself questions about your interests, knowledge, experience, and skills.

Identify things in the world you believe should be better.

What have you noticed in your community that isn't working for everyone? Is there a product you use often that frustrates you in some way? What about your last customer experience could be improved?

Observe friends and family.

Note what products and services they are willing to pay for. Listen to their complaints and try to identify what problems of theirs need solving.

Research trends.

Read trade, business, and financial publications. Follow influencers and business leaders. Keep track of changes in technology, consumer behavior, and society at large. Soak up trends reports.

Develop a sales strategy.

Once you've decided what to sell and to whom, you need to decide how you're going to reach the market and make a profit. There are a number of types of online businesses including software-as-a-service, affiliate marketing, e-commerce, online tutoring, freelancing, etc.

Name your online business.

Brainstorm ideas.

When naming your online business, find a name that is simple, memorable, and compelling. It should in some way reflect the product or service you offer.

Create a list of relevant keywords, slang, jargon, etc, and then combine them in interesting ways.

Revisit your mission statement or core values to see if anything there sparks an idea.

Research similar businesses and decide what it is about their names you like and dislike.

Use NameSnack to generate a unique name.

Find out if the domain is available.

Once you've found a name for your online business, check to see if the domain is available. Ideally, you'll want the .com, .org, or .net suffixes. These are the easiest for people to remember.

Read our guide on how to register a domain name.

Type the domain name into the search bar on domains.google.

If the URL isn't available, consider the alternatives that will pop up in a list along with your search result.

Trademark your online business name.

Once you've found a good name, and have seen that the domain is available, trademark it with the U.S. Patent and Trademark Office.

Go to the U.S. Patent and Trademark Office website.

Click on "Trademarks."

Click on "Trademark basics."

Make sure you fully understand what is required of you.

Click on "Apply for a trademark."

Register on the Trademark Electronic Application System (TEAS).

Create a business plan.

Write the business description first.

Start with the business description section. This section includes legal structure, location, the expected launch date of the website, and all sources of revenue.

Leave space for the executive summary, which will be written last.

Write an operations and management section.

Describe the leadership and management structures of your online business. Make the case for why those in leadership positions are a good fit. Include information about the major departments such as sales, legal, marketing, design, etc.

Break down your marketing strategy.

In another section, discuss your marketing strategy. Include information on the target market, promotional opportunities, marketing goals, and relevant metrics.

Include the information about your strengths, weaknesses, opportunities, and threats in this section.

Describe the competition.

In the next section, write in detail about industry revenues for the last few years, particularly areas of growth. Then, describe what you know about other similar online businesses. Note what aspects of their business may be in direct competition with yours.

Write the financials section.

Discuss all the financial implications of starting your online business. Include things like start-up expenses, funding, financial operations, revenue projections, and break-even point.

Use our free business plan template to help you with this section.

Outline your future plans.

Without going into too much detail, write about where you see the company heading and what you plan to do next once your online business has covered all opening costs and is able to maintain strong cash flow. This includes hiring staff, adding products or services, leasing office space, etc.

Create the executive summary.

With the information from writing the rest of your business plan still fresh in your mind, go back to the very first page and write the executive summary. It should summarize the most important information from the business plan. Include your mission statement, investment opportunities, and anything that sets your business apart.

Keep your executive summary as short as possible, and try to make it evocative.

Create a legal entity.

Choose your preferred legal structure.

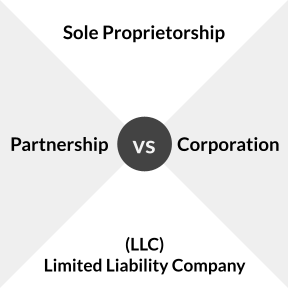

Choose the legal structure that suits your business best. Your options include a sole proprietorship, partnership, limited liability corporation (LLC), or corporation.

Consult a lawyer or accountant before forming a legal entity.

Sole Proprietorship: Operated by just one person, who is then solely responsible for tax and liability issues.

Partnership: Run by two partners who share the tax and responsibilities.

Limited Liability Corporation (LLC): Protects owners from liability while passing taxes on to them. May opt for corporate or partnership tax rules.

Most small businesses choose to register as an LLC because it offers a fair amount of protection against liability, is simple to maintain, and is flexible.

Corporation: A distinct legal entity that is taxed as a business at corporate tax rates and that assumes all liability. Has members and shareholders.

Get the applicable formation documents.

Visit the website of the business formation agency in your state to find out what formation documents and supportive material is needed for you to form your legal entity. Some states allow you to file online. Others simply make the documents available for download.

Appoint a registered agent.

If you are filing an LLC or corporation, you will need to appoint someone to accept official government notifications, usually legal documents and tax forms, on your business's behalf. The person you choose must live in the same state your business operates in. You, as the owner, can be the registered agent.

While you can be your own registered agent, many would advise against it as it means having to be available at all times to receive documents.

File the documents.

Once you've gathered all the information required, and you've filled in the forms, submit them along with any filing fees. Processing times take between five working days and four weeks depending on the state.

Some states allow you to pay a fee to expedite the filing process. This fee can cost between $50 and $100 depending on the state.

Wait for official written confirmation from the formation agency that your legal entity has been formed successfully.

Get an Employer Identification Number.

Register for an Employer Identification Number (EIN). It is a nine-digit number issued by the IRS to businesses for tax identification purposes. It is legally required by businesses looking to employ people and those operating as partnerships or corporations. However, most businesses, even those without employees, will register for an EIN.

If you run a sole proprietorship, the Taxpayer Identification Number (TIN) will take the place of an EIN.

Find out if you're eligible for one.

Complete and submit the application form on the IRS website.

Create social media accounts.

Set up your accounts.

Create accounts on the most popular social media platforms, which are Facebook, Instagram, X formerly known as Twitter, TikTok, Pinterest, and LinkedIn.

If you plan to have multiple social media accounts, a social media management tool will help with scheduling posts and formatting these posts correctly for each platform.

Share regularly.

Share a mix of original and curated content. Be daring and creative with your posts and try to maintain a human voice.

Don't pitch all the time. Sometimes, just be helpful.

Make engagement with others part of your strategy.

Aside from sharing content, spend time engaging with your audience directly. Leave comments, share, and like other people's content. Engaging with your audience should be seen as a way to create relationships, not a fingerhold to a potential sale.

Respond to messages and comments as soon as possible.

Consider offering customer service on social media.

Use social media to listen to your customers. Hear their concerns and complaints and respond with solutions. Keep an eye out for where you can be of assistance.

Respond within 10 minutes if possible.

Launch your business.

Advertise through social media.

Consider paying for a social media ad to get an initial push behind your new brand. Platforms including Facebook, Twitter, and Instagram have paid advertisement services that may be useful for reaching a wider audience.

Reach out to niche forums, social media groups, and newsletters.

If your target market is a specific group of hobbyists or professionals, approach dedicated news hubs and social media groups for advertising opportunities.

Encourage new followers to join your mailing list.

Make it easy for people to subscribe to your newsletters by setting up a sign-up form on your social media platforms. And then use incentives to give people that extra little push.

Books You Should Read Before Starting an Online Business:

- The Lean Startup by Eric Reis.

- Will It Fly? by Thomas K. McKnight.

- The E-Myth Revisited by Michael E. Gerber.

- The Barefoot Executive by Carrie Wilkerson.

- Lucky or Smart? by Bo Peabody.

- The Art of the Start by Guy Kawasaki.

- The Six-Figure Second Income by David Lindahl and Jonathan Rozek.