Enter your brand or company name to get started.

How to Start a Business in South Dakota Checklist:

Stay on task and cover your bases with our detailed checklist.

Download NowHow to Start a Business in South Dakota:

Entrepreneurs who are interested in starting a business in South Dakota will enjoy the state's business-friendly tax system, growing workforce, and low business registration requirements and costs. Businesses that tend to thrive in this economic climate are typically found in the agriculture, mining, manufacturing, and transportation industries.

Form your business.

Review South Dakota formation options.

South Dakota offers four main ways of forming your business, which we cover in detail below. Review these closely and pick the one that fits your business best.

Name your business.

Your business name will play an intricate part in your brand building and marketing strategies. Therefore, you'll want to ensure that you choose a memorable and creative name that's legally available in your state. In South Dakota, all business names must be registered with the Secretary of State.

To remain compliant, make sure that you perform a business entity search before filing a name reservation application. This application will guarantee that your ideal business name is secure for 120 days.

If you need help finding a business name, be sure to check out NameSnack's free business name generator.

Make a list of names that you like and perform a Google search to find any conflicts with other South Dakota business names.

Visit the South Dakota Secretary of State website and conduct a business name availability search.

Once you've confirmed the availability of your name, search for the Application for Reservation of Name on the SOS website.

Complete the form and file it on the SOS Business Services Online portal. There is a $25 filing fee.

You can check out our guide on How to Register a Business Name to assist you.

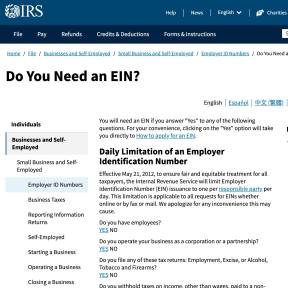

Get an employer identification number.

Nearly all businesses will need to register for federal taxes by applying for an employer identification number.

Register your business in South Dakota.

All business structures can be registered through the South Dakota Secretary of State website, with the exception of general partnerships (GP) and sole proprietorship. The process for registering a new business online is fairly simple, with almost everything available at your fingertips, including the appropriate formation forms and an online business portal.

Go to the South Dakota Secretary of State website.

In the main menu, click on "Start / Register a New Business." This will take you to an information page in a separate tab.

On the information page, click on the green box in the right-hand corner that reads, "Start a New Business."

Complete the on-screen prompts and include your formation documents.

Pay the filing fee and submit.

Obtain necessary permits and licenses.

The state of South Dakota does not require businesses to have a statewide business license. However, depending on the type of business that you start, you may require specific business licenses or permits from separate government agencies in order to operate in the state.

Most businesses in South Dakota are required to apply for a Business Tax License with the Department of Revenue. You will receive your license once you register for sales tax.

You can consult with the South Dakota Governor’s Office of Economic Development to check on specific business licenses and permits that you may require.

You can also get more information from this complete list of licenses and permits required by each state department.

Register your business for taxes.

Register for sales and use tax.

Every business selling taxable tangible personal property in the state of South Dakota is required to obtain a sales tax license and contribute to sales tax. Services rendered are not taxable. You will need to register for a sales tax license with the South Dakota Department of Revenue.

Go to the South Dakota Department of Revenue website.

On the homepage, hover over the drop down menu labeled "Businesses."

In the drop down menu, click on "Taxes." This should take you to a complete list of taxes. Click on the option that reads, "Sales & Use Tax."

On the next page, click on "Tax License Application" in the right-hand side menu. This should take you to a separate tab with information on how to file with or without a registered account.

If you choose to apply for a tax license without an account, you'll be required to complete the on-screen prompts. This section will ask for all your tax and personal information. However, it's important to note that you will not have access to the information once your application is submitted.

Register for municipal tax.

In South Dakota, all businesses are also expected to collect and pay municipal sales or use tax, and the municipal gross receipts tax. The average sales and use tax rate is between 1% and 2%. To remain compliant and automate your filing system, you can report municipal sales tax, use tax, and gross receipts tax on the same tax return as the state sales and use tax.

When you apply for a state sales and use tax license, you can also apply for municipal sales and use tax license using the same form.

Visit the Tax License Application page on the Department of Revenue website.

Scroll down and complete the on-screen application without an account or log in to fill in the secured tax license application.

Register for reemployment assistance tax.

In South Dakota, your small business is required to establish an account with the South Dakota Department of Labor & Regulation. Once you register for an account, you will be assessed to determine if your business qualifies for reemployment assistance tax.

The reemployment assistance program is regulated by the Reemployment Assistance Tax Unit and is funded by the employer's payroll taxes. Thanks to this program, an unemployed individual will be able to receive benefits or have them paid out to claimants if eligible.

If your business is required to contribute towards the reemployment assistance tax, you will need to register with the department and file quarterly reports.

Go to the Reemployment Assistance Tax page on the Department of Labor & Regulation website.

Scroll down and click on the tab that reads, "Log In Here to Register Your Business."

Follow the on-screen prompts.

Hire employees and comply with state requirements.

Report newly hired employees to the state.

To start hiring you will need to register with the South Dakota Department of Labor & Regulation. In accordance with the Personal Responsibility and Work Opportunity Act, each employee will need to be registered within 20 days of starting work. This includes previous employees who have been absent from work for 60 consecutive days.

Go to the New Hire Reporting page on the Department of Labor & Regulation website.

On the page, click on "How To Report" in the left-hand side menu.

Here, you will be given the options to report new employees online, through file transfer, or by phone, mail, or fax.

For quick service, we recommend using the online option. However, you will need to register an account to complete and file the online new hire reporting form.

Consider getting workers' compensation insurance.

In South Dakota, employers are not legally obligated to obtain workers' compensation insurance. However, the Department of Labor & Regulation highly recommends that you do obtain workers' compensation for the benefit of your employees. If you do choose to obtain workers' compensation insurance, you can join the South Dakota Workers’ Compensation program.

Visit the Department of Labor & Regulation website for a more in-depth look at workers' compensation programs and benefits.

Display state-mandated posters throughout the workplace.

The South Dakota Depatment of Labor & Regulation requires all employers to display two state-mandated posters. These include the reemployment assistance employee notification and the safety on the job posting. Both postings must be displayed in a populated area in the workplace to ensure that all employees have access to the information.

In addition to the state-mandated posters, South Dakota employers are also required to display federal posters.

For a complete list of posters, visit the Department of Labor & Regulation posting requirements page.

South Dakota Business Types:

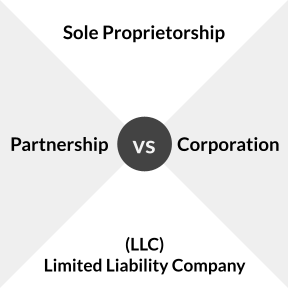

1. Sole Proprietorship.

A sole proprietorship generally involves one individual who takes complete liability for the business. Because this is the simplest business structure, the state does not require any formal documentation to start a sole proprietorship in the state.

However, business owners are still required to comply with tax regulations and if they conduct business under a different name than the owner's first or last name, they'd have to file for a fictitious business name.

2. Partnership.

A partnership consists of two or more individuals who take on all the responsibilities of the business. The most common type of partnership recognized in the state is the general partnership (GP). While it is recommended that you complete and file a Statement of Authority, there are no official formation documents required by the state to start a GP.

You also have the option of choosing a limited partnership (LP) or a limited liability partnership (LLP). These two structures have a different registration system than the GP. With an LP or LLP, you must complete and file formation documents with the South Dakota Secretary of State.

3. Limited Liability Company (LLC).

The limited liability company (LLC) structure is one of the more popular business structures thanks to its minimal paperwork, flexibility, tax benefits, and simple implementation process. To start an LLC in South Dakota, you must complete and file the Articles of Organization with the South Dakota Secretary of State.

4. Corporation.

Corporations typically include shareholders and a board of directors. Despite its formal structure, the process for starting a corporation in South Dakota is fairly simple. You will need to complete and file the Articles of Incorporation with the South Dakota Secretary of State.

How to Start a Business in Utah

South Dakota Business Registration Fees:

Fee Type | Cost |

|---|---|

Name Reservation | $25.00 |

Articles of Organization | $165.00 |

Articles of Incorporation | $165.00 |

Certificate of Limited Partnership | $125.00 |

Statement of Qualification (Domestic LLP) | $125.00 |

Statement of Authority (GP) | $125.00 |